The annual LexisNexis® Risk Solutions Auto Insurance Trends Report explores how trends in U.S. consumer auto insurance shopping, driving violations, claims frequency and severity, vehicle safety features and more are impacting the auto insurance policy lifecycle from quote to underwriting to claims.

Throughout 2022, U.S. auto insurance carriers continued to navigate a precarious mixture of increased costs, limited vehicle sales, rising accident severity and regulatory pushback on proposed rate increases, setting the market on a collision course away from profitability.

The 2023 report examines key trends from the previous year and offers insights to help insurers make better business decisions now – and into the future.

Download the Report to Discover:

- What is a hard insurance market and how long will it last?

- Key factors contributing to the rise in claim severity.

- The fall and rise of policy shopping and switching.

- Consumer and insurer sentiments towards telematics usage and adoption.

- How the rebound of miles driven impacts major and minor violations for assessing risk

Claims Severity Rose in 2022

Every claims parameter percentage increased during 2022, following the upward trend that began when people got back on the roads as the pandemic shutdowns subsided in 2020.

Here are two notable statistics from our report. Since 2019:

• Bodily Injury and Property Damage severity have increased by 35%

• Collision severity has increased by roughly 40%

These findings directly correlate with the increase in Total Loss claims, which accounted for 27% of Collision claims for the first nine months of 2022―up from 24% for the entirety of 2021. Increases in the number and severity of claims can put pressure on claims units, which are already struggling with staffing shortages.

The good news is, automated solutions that quickly deliver comprehensive claims data directly into your workflow not only help make your adjusters’ lives easier, they help you process claims faster―and that can be a big boost for customer satisfaction.

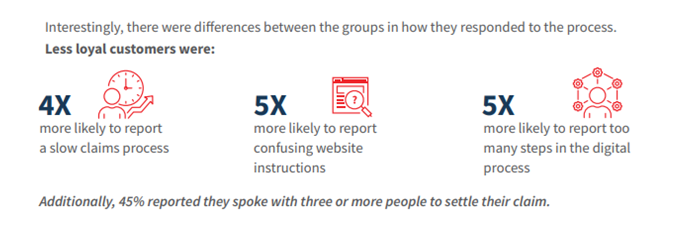

Because customer satisfaction is a significant focus for claims departments, we sought to better understand the correlation between the customer claims experience and a policy holder’s decision to switch insurers―the ultimate expression of dissatisfaction.

In August of 2022, we surveyed roughly 1,400 customers who had filed a claim within the past 12 months. We asked a series of questions about the claims experience, ranging from the overall process to digital claims filing options and payments. We discovered that a combined 94% of respondents were either very satisfied or somewhat satisfied with their claims experience―67% and 27% respectively. However, we found that just because customers report some level of satisfaction with their claims experience . We found that 33% of respondents still switched insurers or considered switching following their claims experience.